“We see a shift from stigmatization toward criminalization of investing in higher oil production.” – Bob McNally, former White House official, “This Time Is Different” Bloomberg May 30, 2021

“From today, halt all investment in new fossil fuel supply projects and make no further final investment decisions for new unabated coal plants.” – IEA Roadmap to Net Zero by 2050

Whether you think global warming is a hoax and no technology has done more to uplift billions of people out of abject poverty than the harnessing of fossil fuels, or you think the burning of fossil fuels is irreversibly destroying the planet and urgent action to halt their use should be the top priority of humankind, or even if you think both of these things, this article is for you.

I can assure all sides the following: unless something substantial changes – and soon – the price of oil is going way higher. Is $300 oil probable? Perhaps not, but it makes for excellent clickbait. Is $300 oil impossible? Absolutely not.

Consider some history.

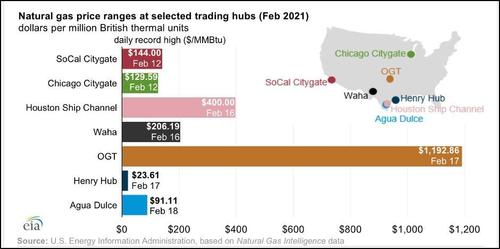

In the third week of February, 2021, a massive cold snap impacted much of the Lower 48 states. The power grid in Texas nearly collapsed. Just as demand for heating and power was reaching its most desperate apex, the supply of natural gas collapsed. The infrastructure simply couldn’t handle the depths of the freeze. The result? Prices of natural gas at several large trading hubs across the US skyrocketed to unthinkable levels. This chart from the US Energy Information Administration captures it well:

So how can we compare these prices to the price of oil? One of the problems with comparing quoted prices for different sources of energy is they are priced in different units, which is mostly an accident of history. For example, natural gas is priced in dollars per million British thermal units (BTUs), whereas oil is priced in dollars per barrel (a barrel being 42 gallons), and gasoline is priced in dollars per gallon (a gallon being a gallon). Habits are hard to break.

To create an apples-to-apples comparison of what these prices mean, a useful trick is to first levelize everything to millions of BTUs, which is how natural gas is sold anyway, and it just happens to be a direct measure of the inherent energy content embedded in a fuel. A standard barrel of oil contains 5.8 million BTUs. If you take the current price of oil (in dollars per barrel) and divide it by the current price of natural gas (in million BTUs), you’ll almost always get a number higher than 5.8, which makes sense because oil is generally more useful than natural gas and natural gas is often a byproduct of oil production. But on an energy-content-equivalency basis, 5.8 is the number. To put natural gas prices into an energy-contained-in-oil-equivalency basis, we simply do the reverse and multiply the price of natural gas, expressed in millions of BTUs, by 5.8.

We are now ready to put the prices for natural gas in the chart above into shocking context. On an energy-contained-in-oil-equivalency basis, natural gas prices reached the following levels in February:

SoCal Citygate: $835 per barrel

Chicago Citygate: $752 per barrel

Houston Ship Channel: $2,320 per barrel

Waha: $1,196 per barrel

OGT: $6,919 per barrel

Henry Hub: $137 per barrel

Agua Dulce: $528 per barrel

Do I have your attention?